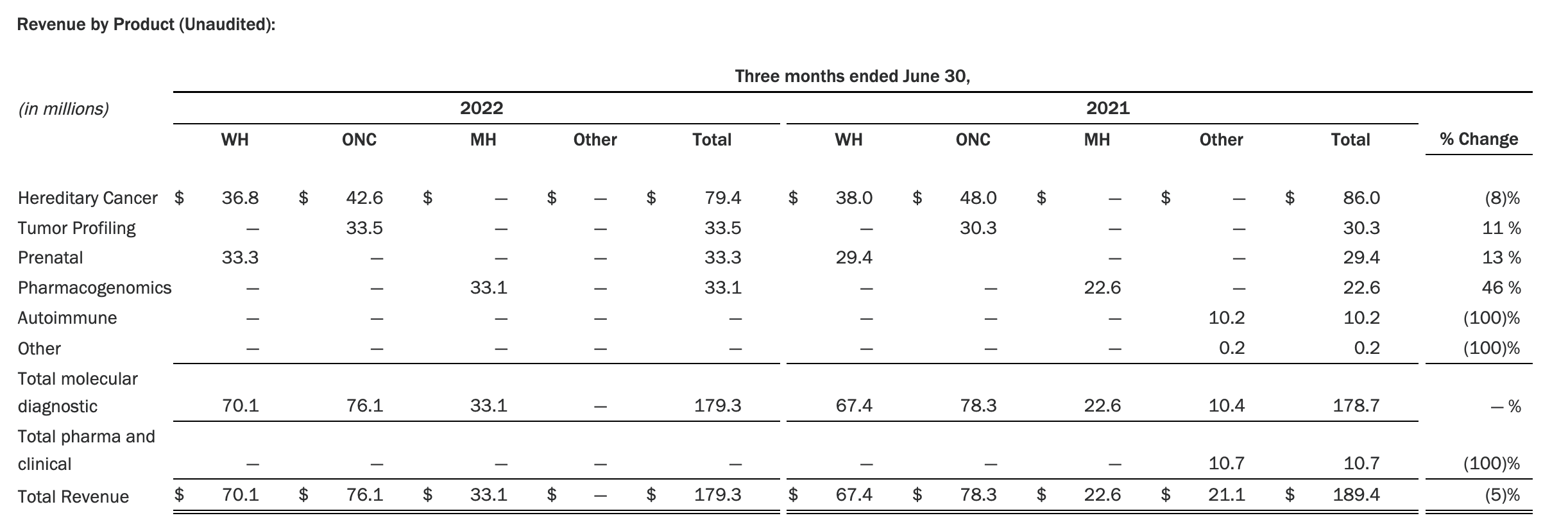

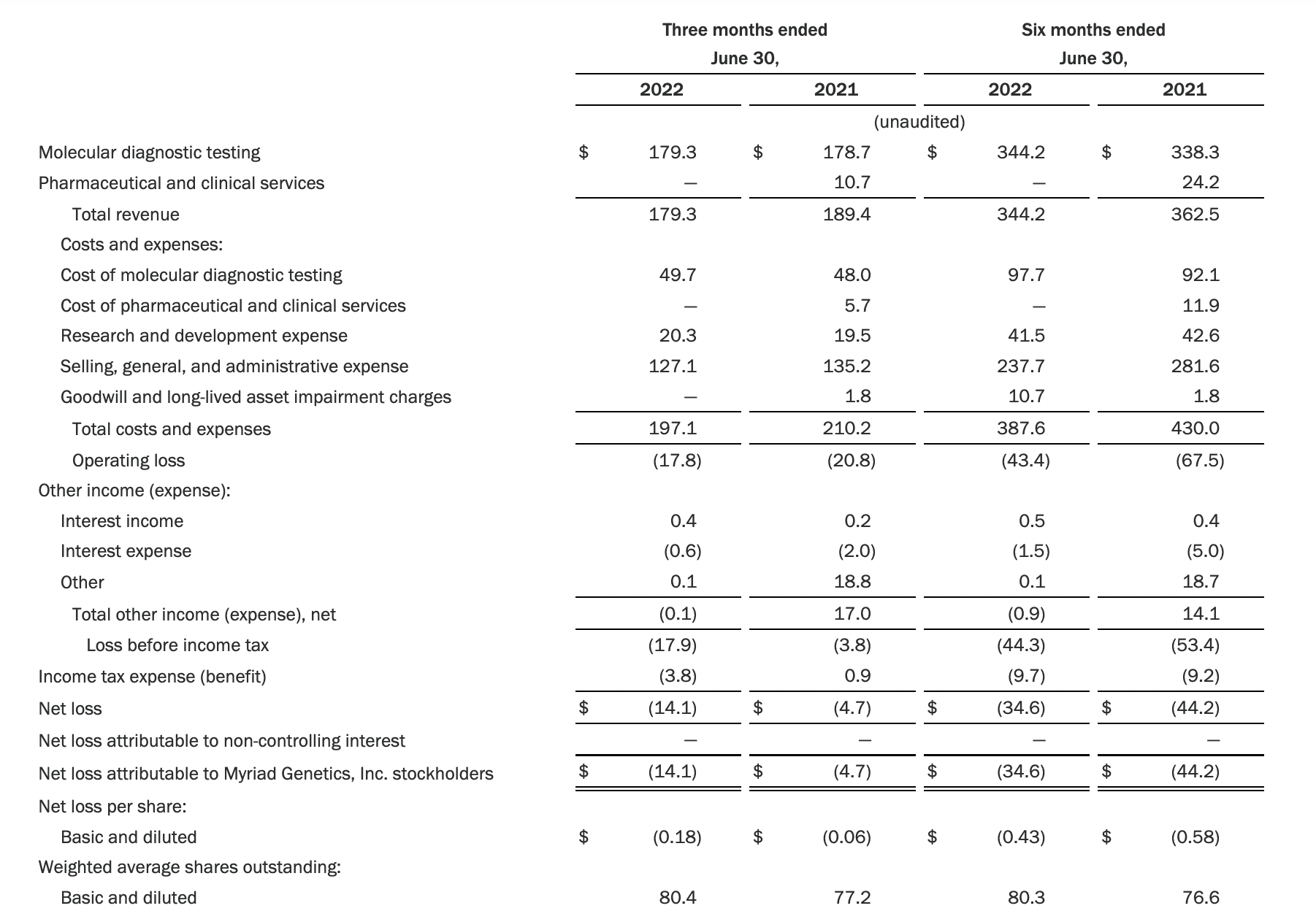

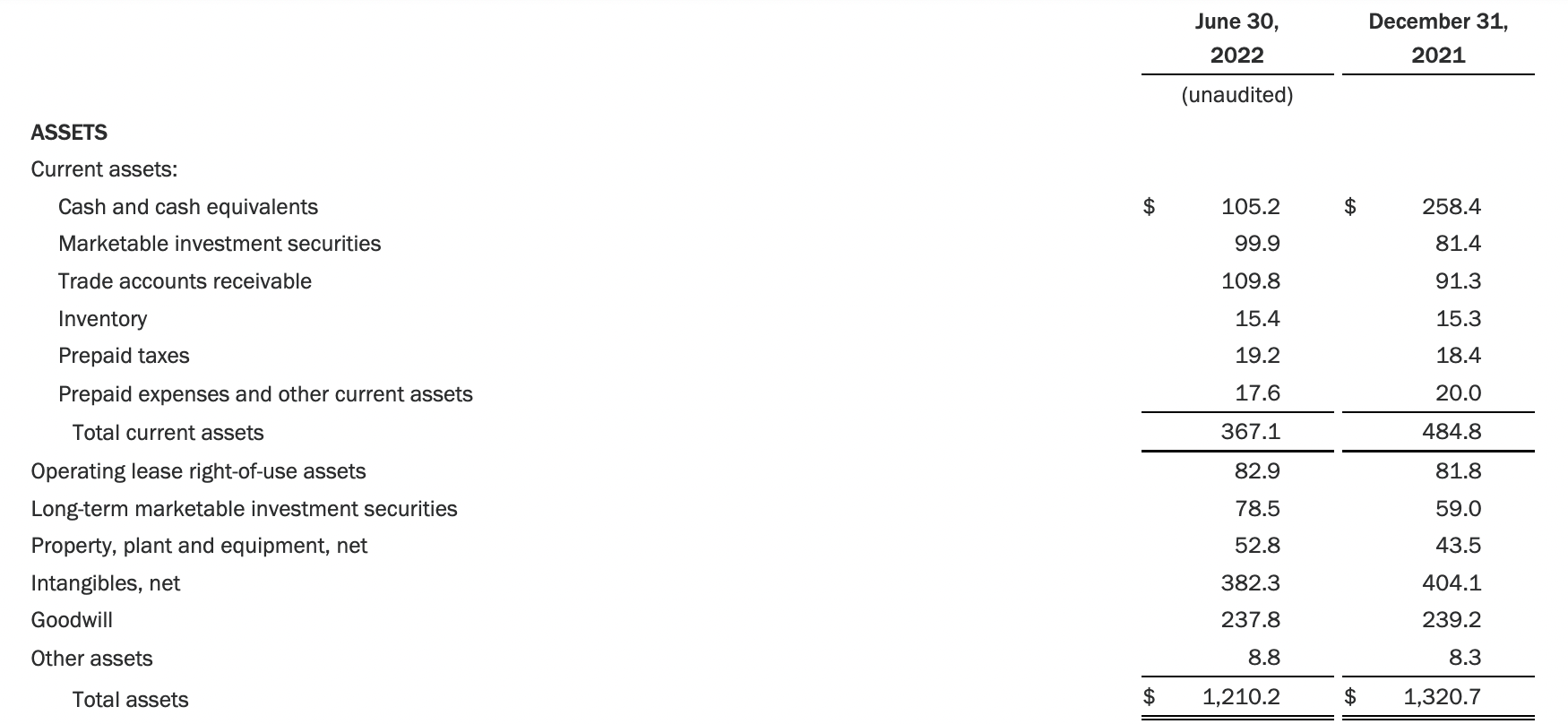

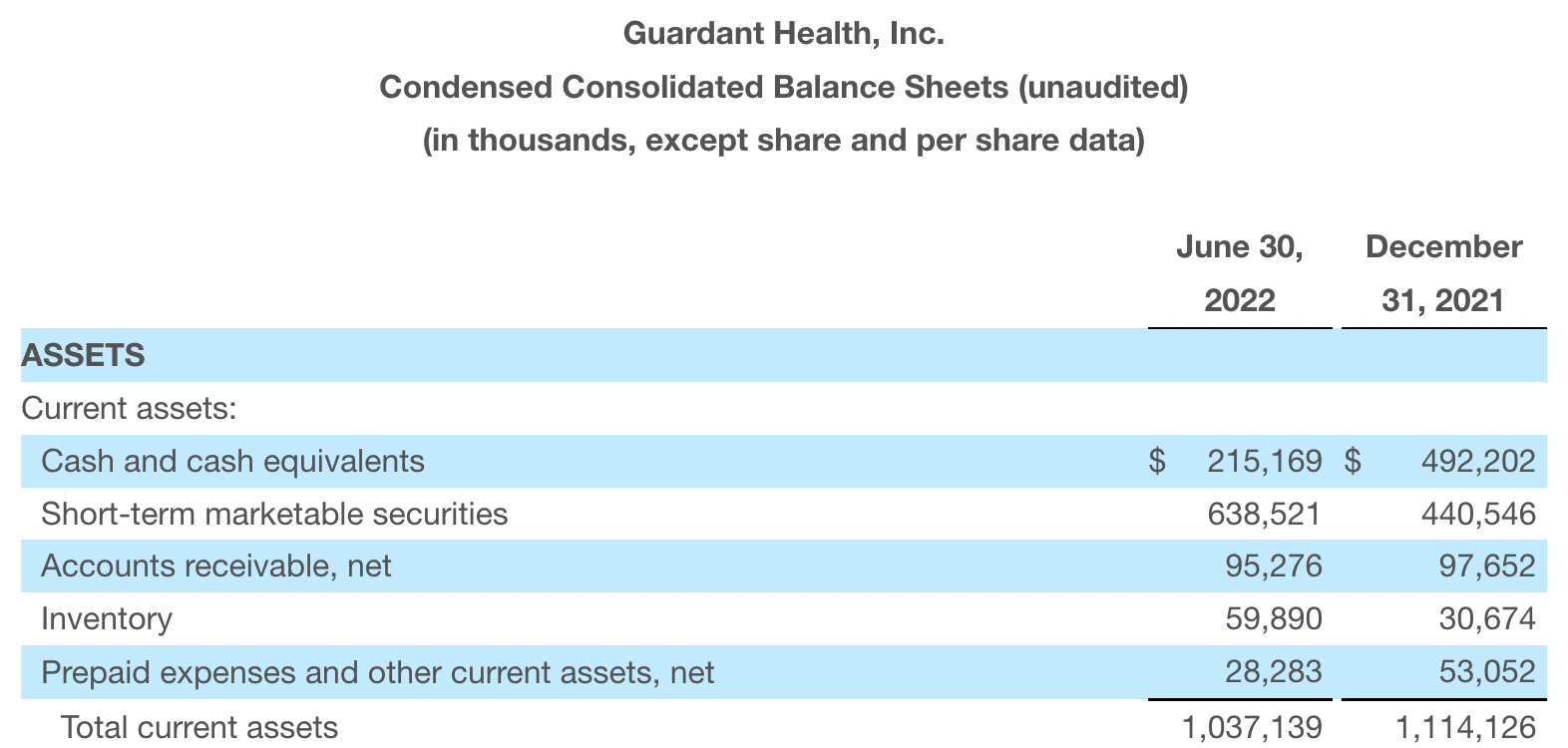

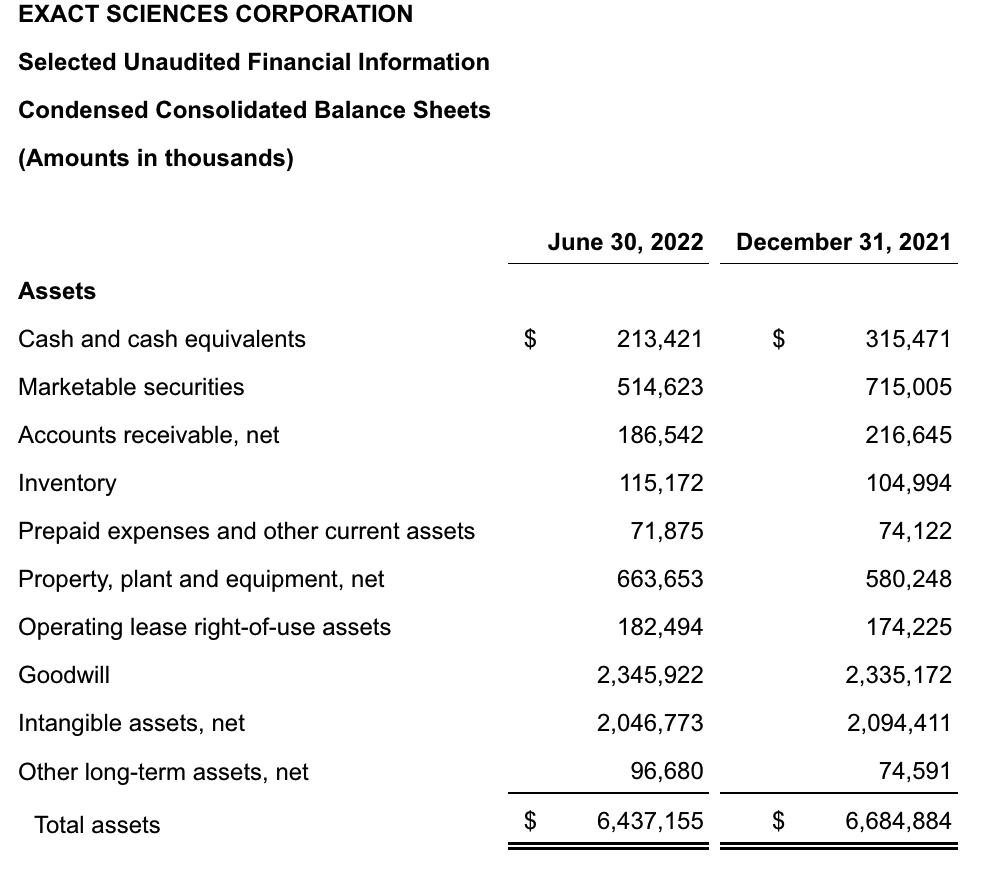

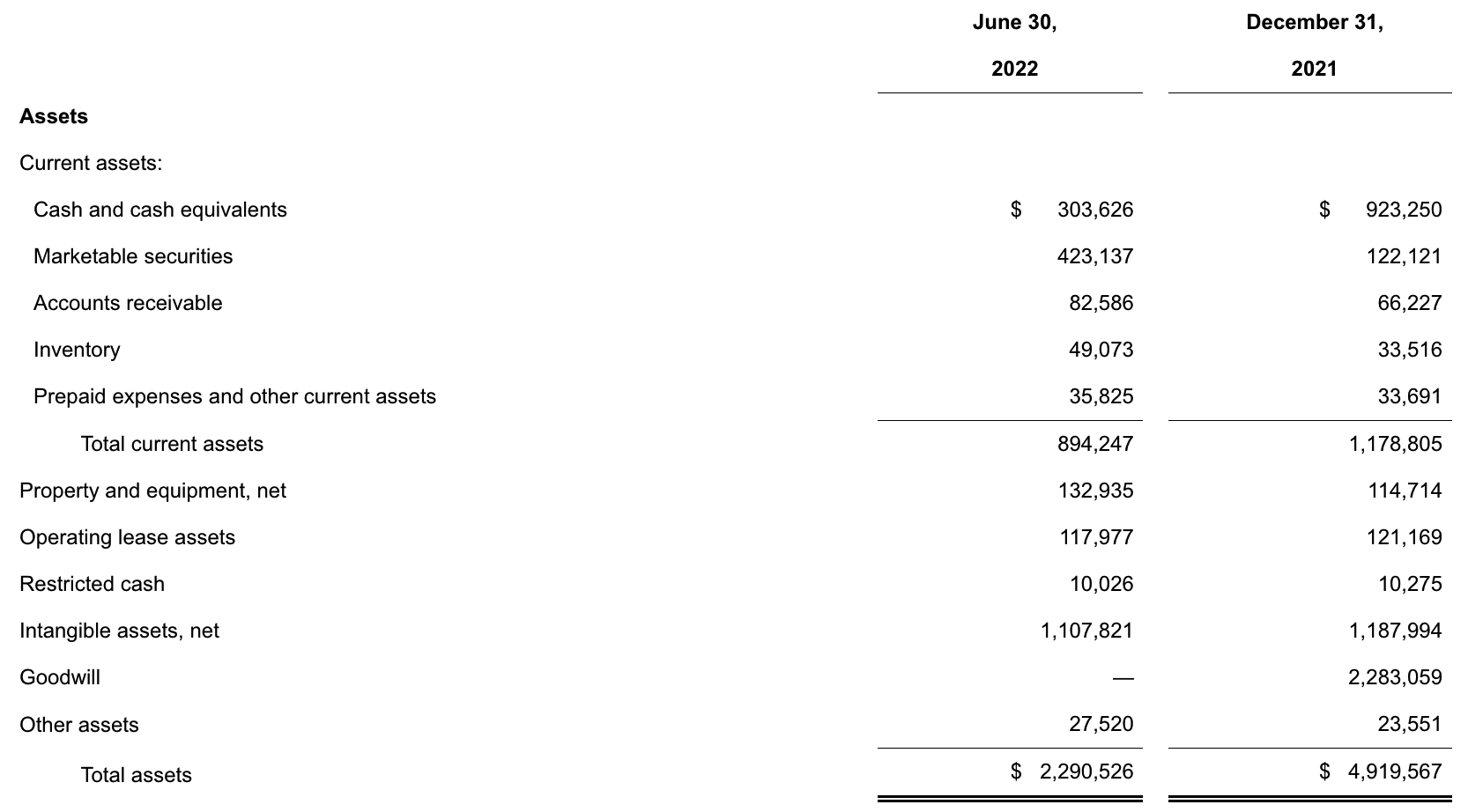

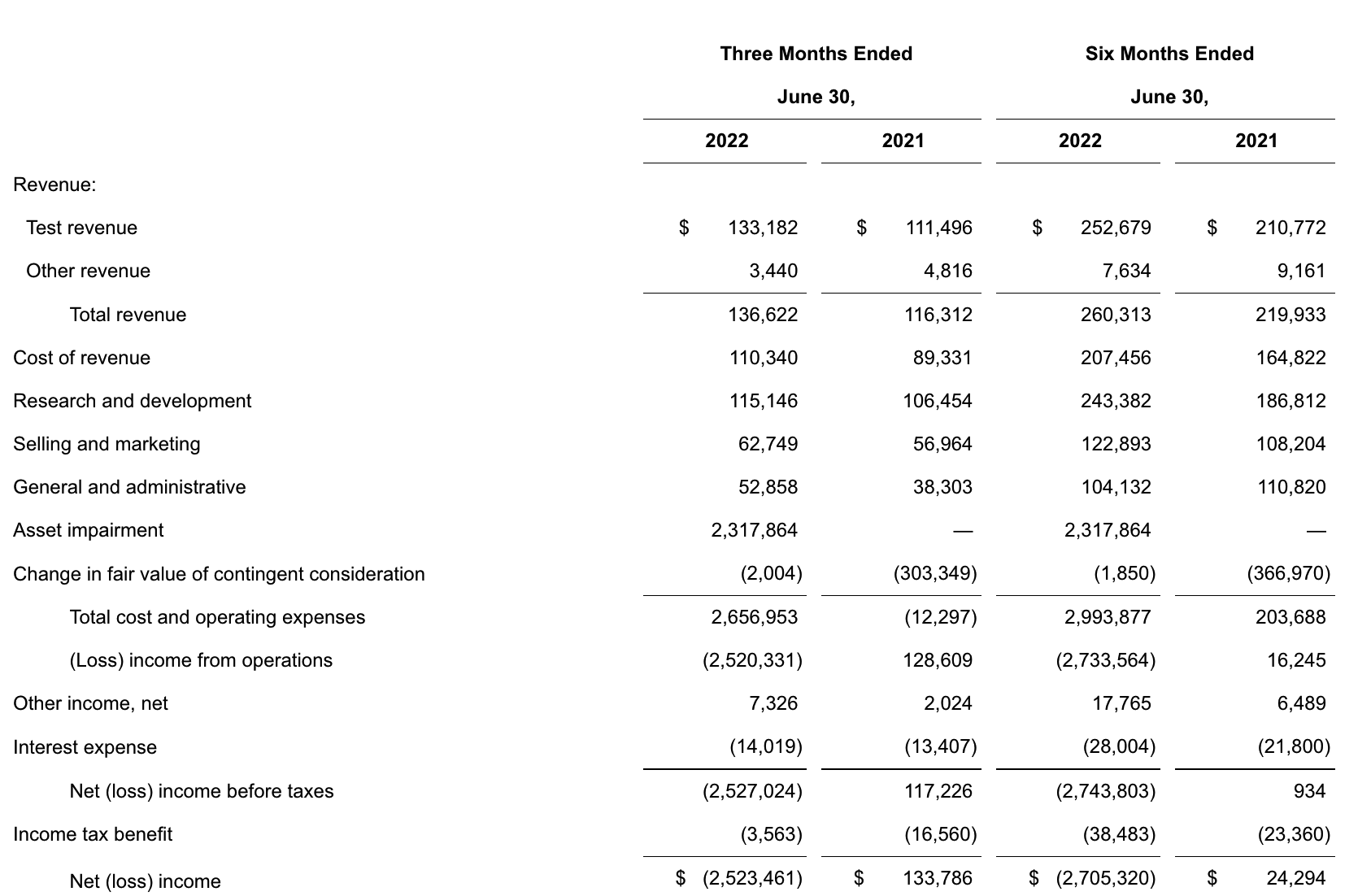

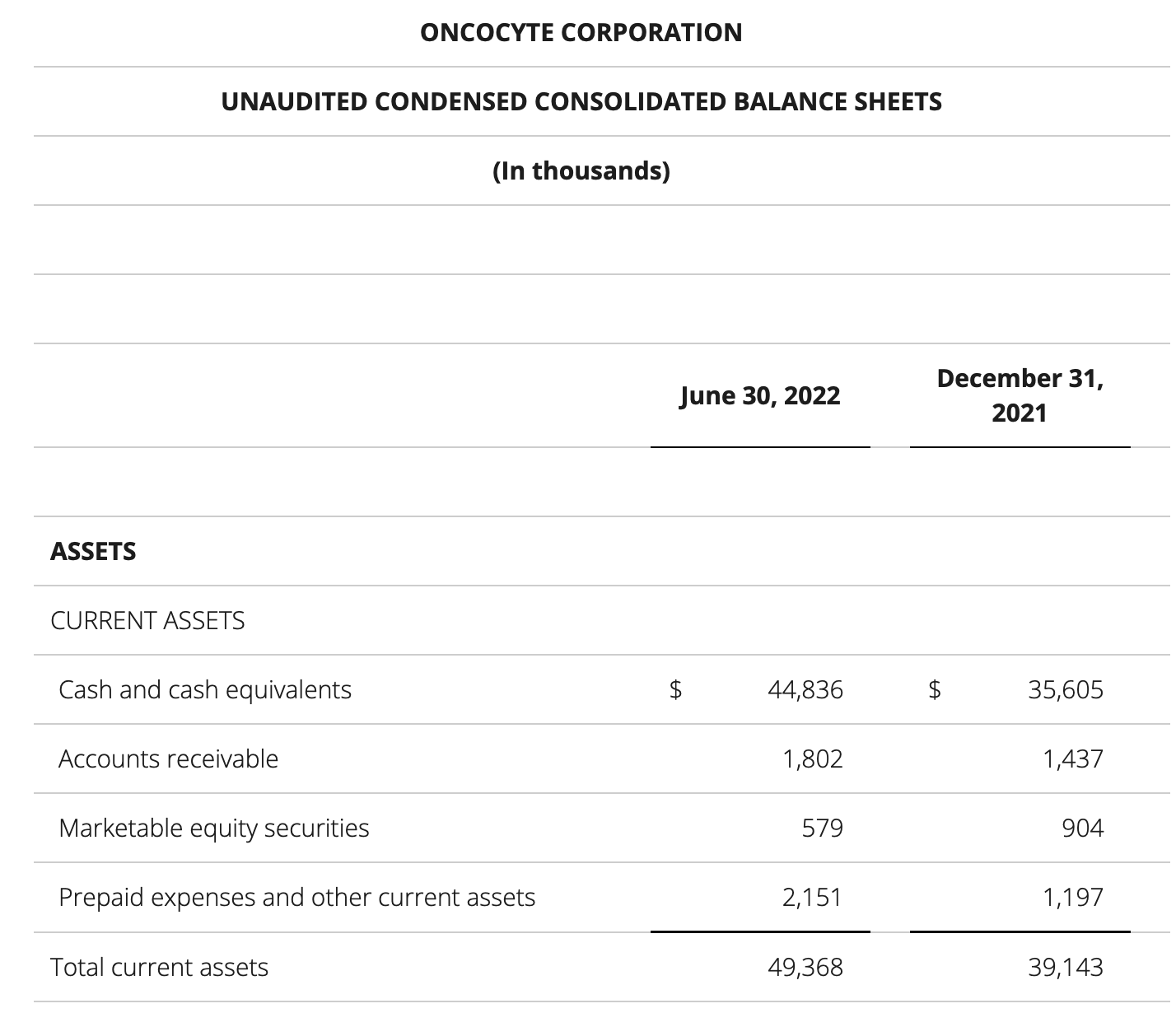

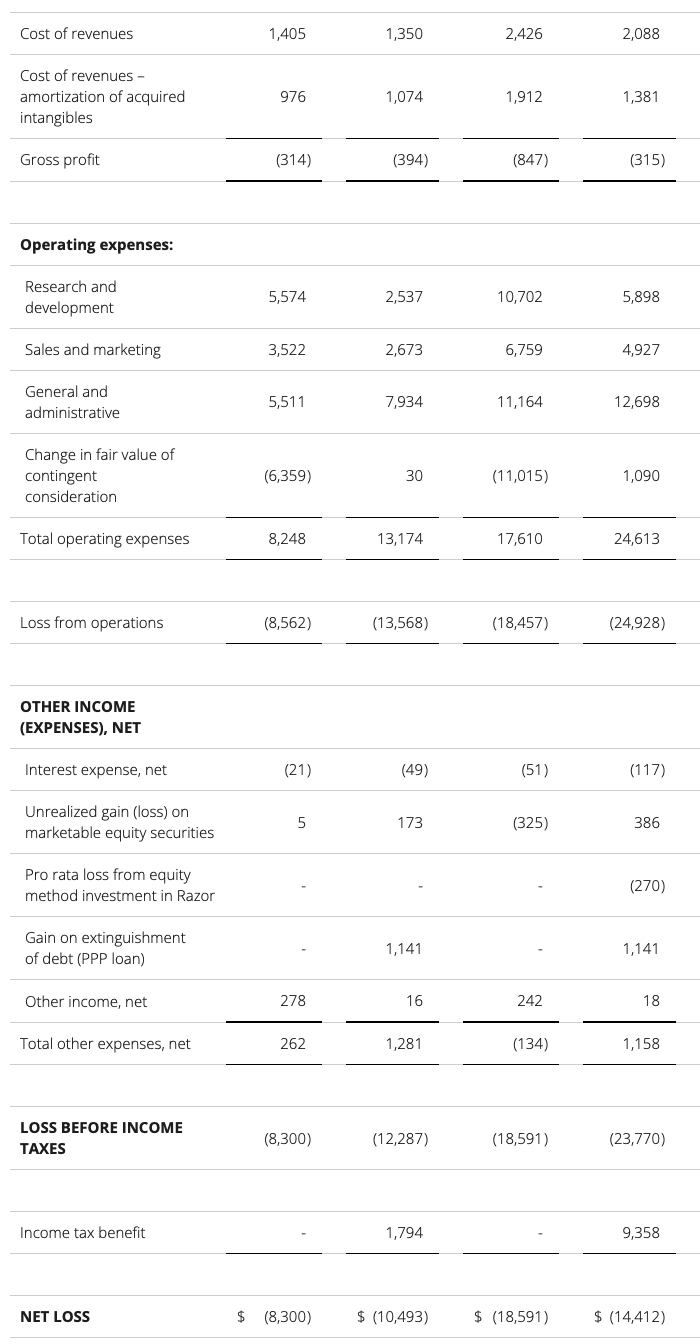

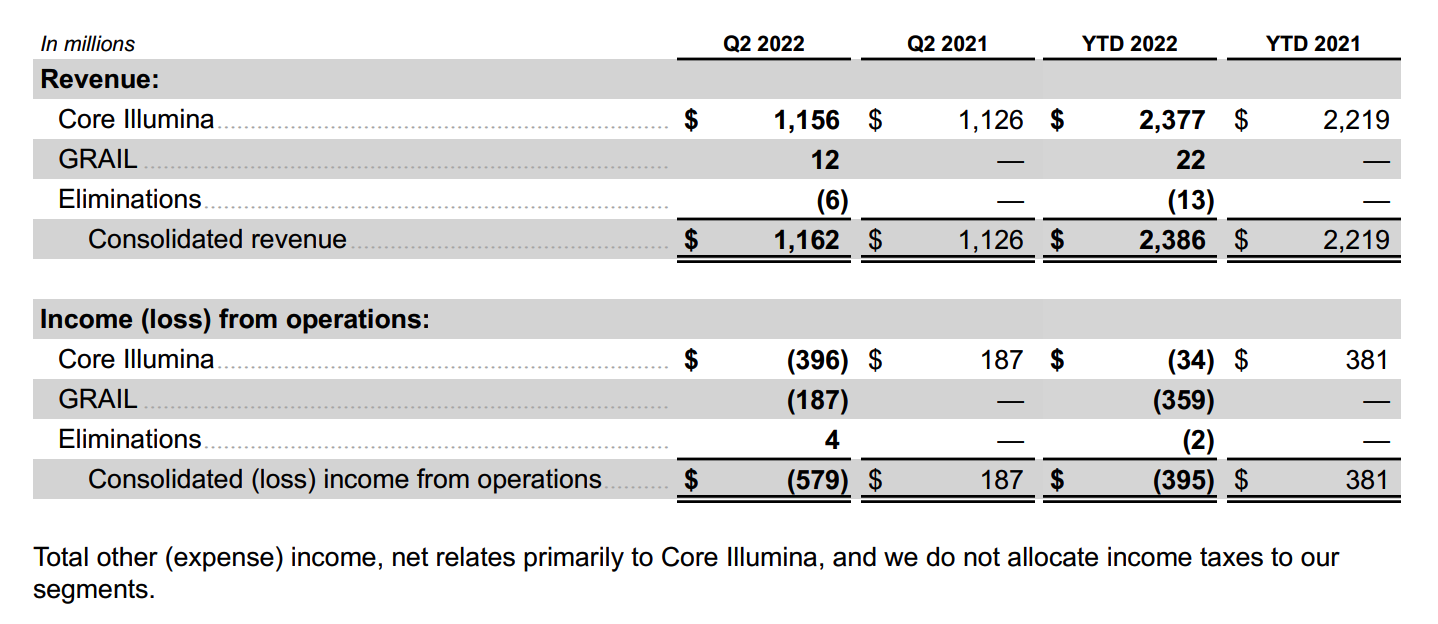

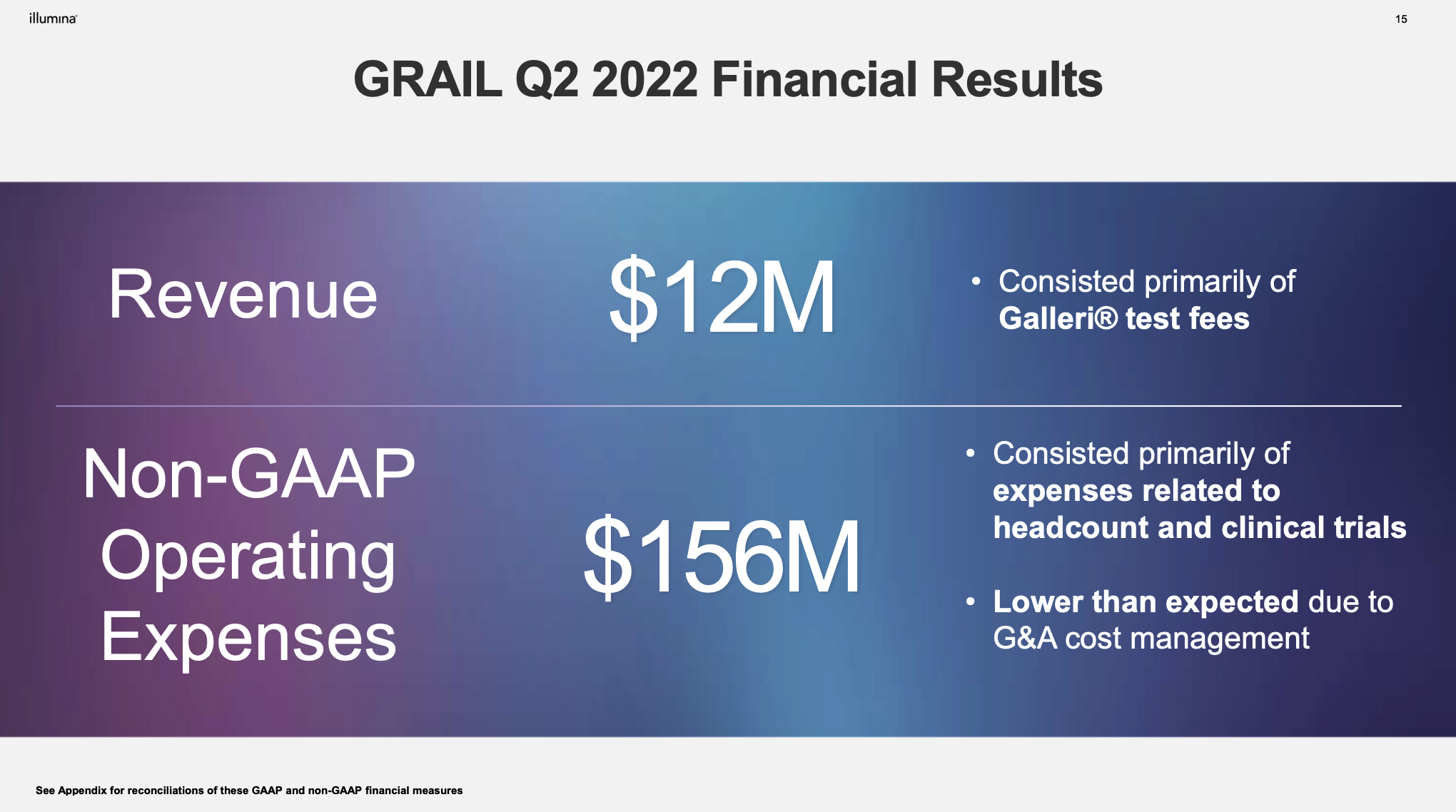

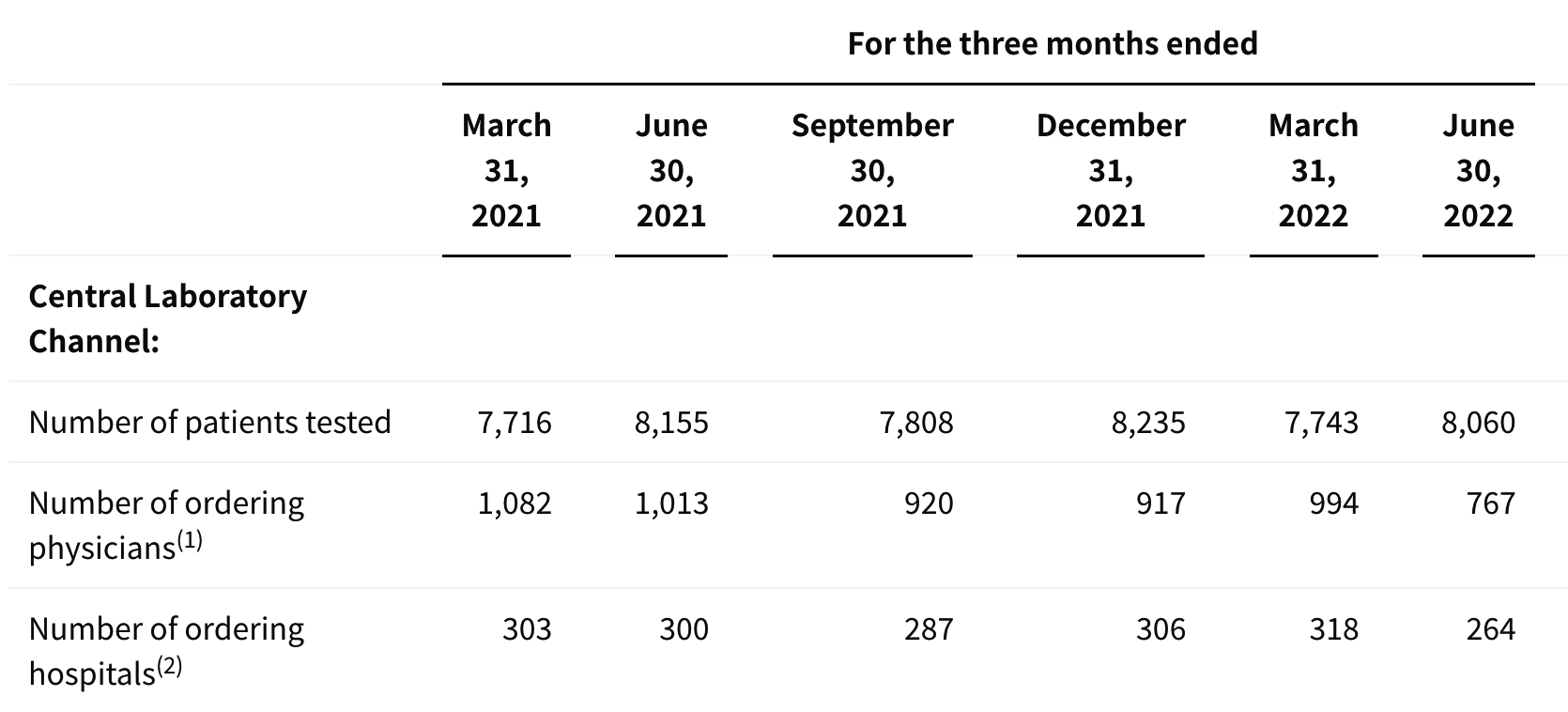

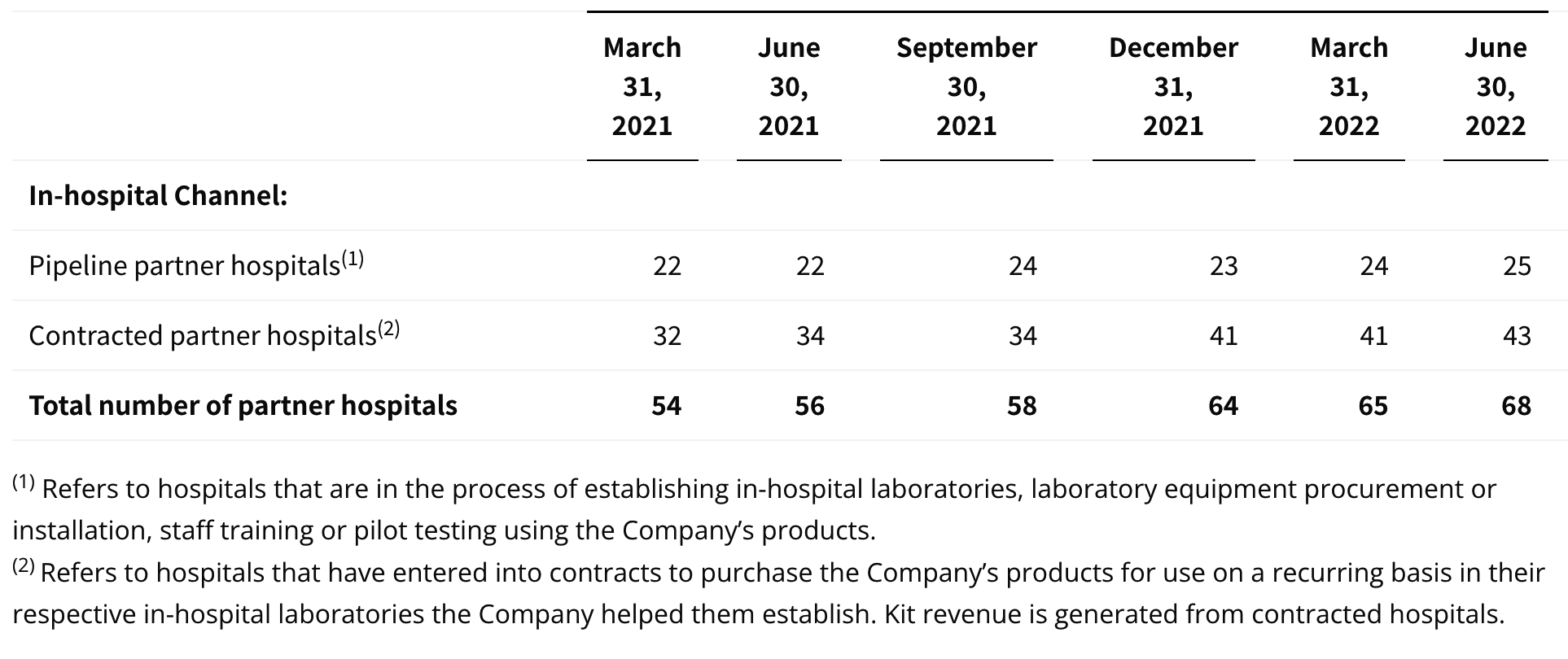

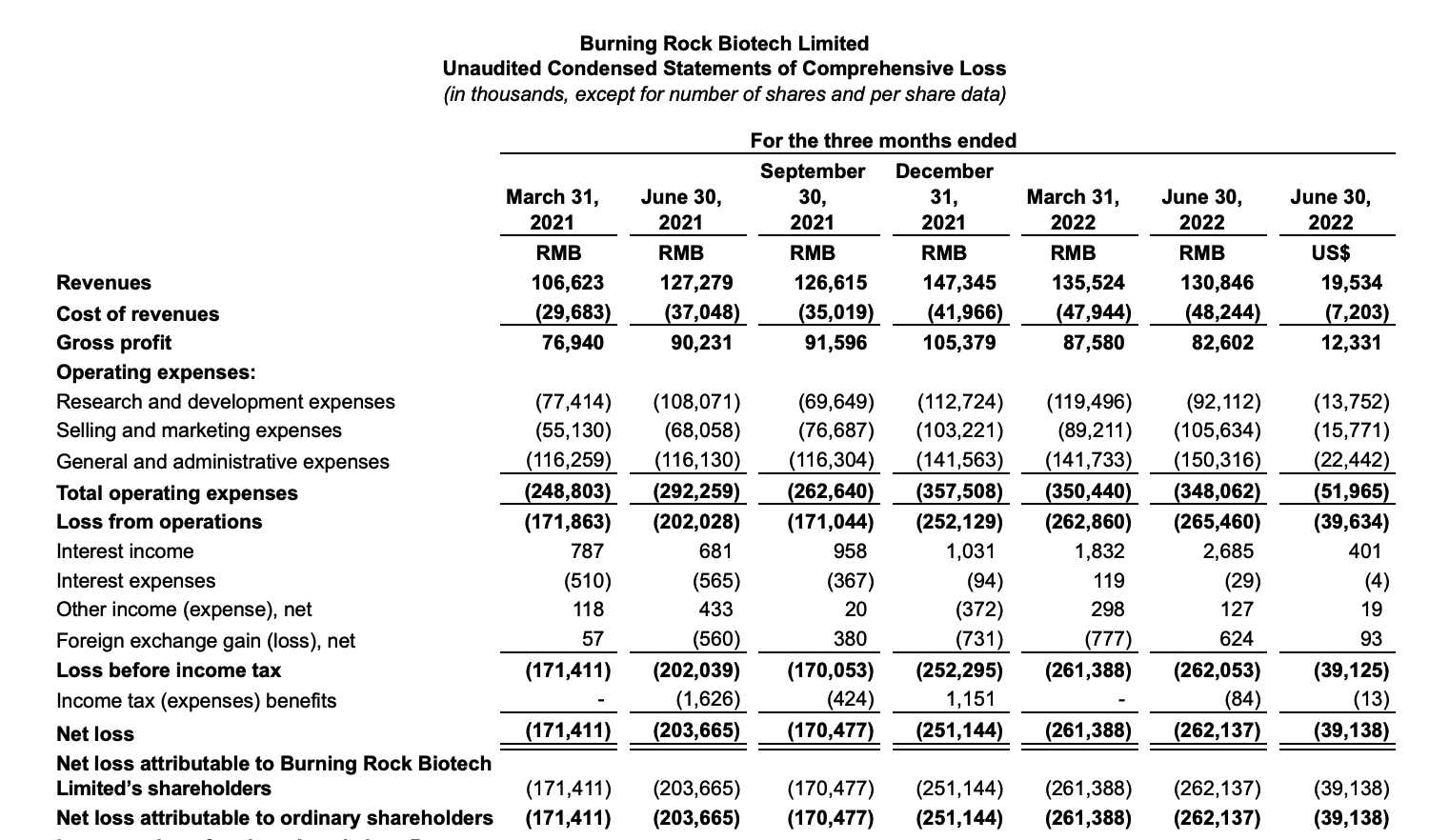

update 2022-08-31 暂时纳入了5家美国上市的公司,分别是Myriad, Natera, Guardant, Veracyte和Exact Sciences,Invitae将于8月9日发布,国内在美股上市的两家公司燃石医学和泛生子后续发布后将一并补充进来。 2022年8月8日这几家公司的股价如下图所示。 News Release Detail | Myriad Genetics Highlights: Oncology The Myriad Genetics Oncology business provides hereditary cancer testing, including the MyRisk™ hereditary cancer test for patients who have cancer. It also provides tumor profiling products such as the myChoice® CDx companion diagnostic test, the Prolaris® prostate cancer test, and the EndoPredict® breast cancer prognostic test. The Oncology business delivered revenue of $76.1 million in the second quarter of 2022, a decrease of 3% year-over-year and an increase of 9% sequentially from the first quarter of 2022. Myriad 2022年第二季度的收入同比下降了5%。该期间的总收入为1.793亿美元,低于上年第二季度的1.894亿美元。Myriad本季度净亏损1410万美元,而去年同期亏损470万美元。本季度末拥有1.052亿美元的现金和现金等价物。 Natera Reports Second Quarter 2022 Financial Results | Natera 第二季度总收入增长了40%,主要是受Signatera强劲增长的推动,特别是在结直肠和免疫疗法方面。收入增加到1.982亿美元,而去年同期为1.42亿美元。 2022年第二季度的产品收入增长39%,达到1.946亿美元,而去年同期为1.396亿美元。今年目前的进展使该公司有信心在2024年中期实现现金流平衡。 Natera公司第二季度的净亏损为1.452亿美元,而2021年同期的净亏损为1.16亿美元。 截至2022年6月30日,Natera持有约6.387亿美元的现金、现金等价物、短期投资和限制性现金(其中现金和现金等价物0.91亿),而截至2021年12月31日的现金为9.145亿美元(其中现金和现金等价物0.84亿)。 Guardant Health, Inc. - Guardant Health Reports Second Quarter 2022 Financial Results Recent Highlights 截至2022年6月30日的三个月,收入为1.091亿美元,比截至2021年6月30日的三个月的9210万美元增长19%。精准肿瘤学收入增长了27%,主要是受临床检测量和生物制药样品量增加的推动,这两个数字分别比上年同期增长了40%和65%。 截至2022年6月30日,现金、现金等价物和有价证券为12亿美元。其中现金和现金等价物2.15亿美元,2021年底为4.92亿美元。2022 Q2 净亏损2.29亿美元,2021年同期为0.97亿美元。 Veracyte Announces Second Quarter 2022 Financial Results | Veracyte, Inc. 2022年第二季度的总收入为7290万美元,与2021年第二季度的5510万美元相比增长了32%。检测收入为5970万美元,与2021年第二季度的5080万美元相比增长了18%,主要是由泌尿科检测的强劲表现所驱动。产品收入为310万美元,与2021年第二季度的270万美元相比,增长了16%。生物制药和其他收入为1,000万美元,与2021年第二季度的160万美元相比增加了840万美元,主要是由收购HalioDx的贡献所推动。 Veracyte第二季度的净亏损为950万美元,而去年同季度为900万美元。本季度末拥有现金、现金等价物和短期投资1.640亿美元。预计2022年全年总收入将达到2.72亿美元至2.8亿美元,同比增长24%至28%。 Exact Sciences Corporation - Exact Sciences Announces Second Quarter 2022 Results 该公司第二季度的总收入为5.216亿美元,比2021年同期的4.348亿美元增长20%。肿瘤相关收入为1.54亿美元,同比增长约12%。 该公司宣布将放弃Oncotype DX在前列腺中的检测,以高达1亿美元的价格出售给MDx Health。 Exact公司第二季度的净亏损为1.661亿美元,而去年同期的净亏损为1.769亿美元。该公司第二季度末的现金和现金等价物为2.134亿美元,有价证券为5.146亿美元。 Invitae - Invitae Reports $136.6 Million in Revenue in Second Quarter of 2022 Second Quarter 2022 Highlights Q2收入1.366亿美元,与2021年第二季度的1.163亿美元相比,增长了17.5%。截至2022年6月30日,现金、现金等价物还有3.03亿美金。 Q2净亏损25亿美元,在财报中也特别给出了说明。今年第二季度的净亏损为25亿美元,而2021年第二季度的净收入为1.338亿美元。2022年第二季度的净亏损包括23亿美元的商誉减值,这是由于股价和相关市值的持续大幅下跌以及低于预期的财务业绩的结果。它还包括不确定的无形资产和资产减值3480万美元。 Oncocyte Reports Second Quarter 2022 Financial Results – OncoCyte Corporation Second Quarter and Recent Highlights: Oncotype 的Q2季度财报发布了,先说下几个主要指标。第二季度报告的总收入为210万美元,而2021年第二季度为200万美元。净亏损830万美元。截至2022年6月30日,现金、现金等价物、限制性现金和有价证券为4710万美元。其中现金和现金等价物4480万美元。 此外,他们highlight了比较有意思的两点内容。 一是裁员,组织结构调整预计每年将减少超过450万美元的人力成本,其它的成本削减算在一起预计2023年的年运营成本将比2022年减少约1200万美元。 二是特别提到了国内美股上市的燃石医学。由于燃石医学引进了 Oncotype 的 DetermaRx Lung Cancer Assay,Oncotype 今年获得了他们100万美元具有里程碑意义的付款。 Illumina Reports Financial Results for Second Quarter of Fiscal Year 2022 作为一家专注于肿瘤早检的公司,GRAIL在2021年8月被Illumina收购之后,其核心经营数据也纳入了母公司的财报。后者2022年Q2的财报就分成了两个部分,其中一部分是Core Illumina,另一部分是GRAIL。关于Core Illumina不谈,我们仅仅捡出来GRAIL的部分看看。 Key announcements by GRAIL since Illumina's last earnings release 先说结论,一个季度亏了1.87亿美元。 在PPT版财报上,Illumina 展示 GRAIL 被收购之后的一些动作。 比如在NHS-Galleri试验中招募了14万名参与者,这是对多癌症早检最大的研究;与阿斯利康开展战略合作,开发相关的诊断产品,确定可从新型疗法中获益的高风险、早期患者;与Mercy和Ochsner Health展开合作,将Galleri的服务范围扩大到全美;以及,备受关注的PATHFINDER研究2022年马上就要召开的ESMO大会将会发布最终的研究结果。 另外,PPT里没写,但是财报里提到的,一方面与Fountain Health Insurance合作,提供Galleri作为年度福利。与美国退伍军人事务部和退伍军人健康基金会合作,在未来3年向全美10,000名退伍军人提供Galleri。 这么多大动作,直接反映在钱上,得多费钱呢? Illumina随后展示GRAIL 营收1200万美元,支出1.56亿美元。支出主要还是在人力和临床试验,甚至这个数字由于他们G&A部分费用的控制,甚至要比预期花的少了一些。 值得多说一句的是,Illumina 现在的野心之大和头之铁,已经完全不装了摊牌了。其实一年前收购Grail的时候,这个案子本身就没有通过美国和欧盟的审查许可。在这个行业里的人都明白,你一个卖仪器的上游公司,收购一个用仪器的下游公司,这做法,怎么越看越像大洋彼岸的某个公司。 收购一年多之后,Illumina前一阵子刚刚表示公司已拿出了接近5亿美元的预算,为欧盟可能征收的巨额罚款做准备。GRAIL我是收定了,纳入财报影响我母公司的营收我也认了。 Burning Rock Reports Second Quarter 2022 Financial Results | Burning Rock Biotech Limited Recent Business Updates 在财报里,燃石医学重点强调了三部分内容:院内和MRD推动了增长,新产品占中心实验室收入的7%;早检 PROMISE研究下个月的ESMO公布结果,PREVENT万人前瞻性干预研究启动;药企合作收入持续增长,2022年上半年收入同比增长166.6%,新合同价值1.58亿人民币同期增长49%。 截至2022年6月30日的三个月,收入为人民币1.308亿元(1950万美元),主要为三个部分,中心实验室业务的收入为人民币7860万元(1170万美元),院内业务的收入为人民币3420万元(510万美元),医药研发服务的收入为人民币1810万元(270万美元),其中药企合作的业务比2021年同期增长了166.6%。 钱花到哪里了呢?研发费用为人民币9210万元(1,380万美元),销售和营销费用为人民币1.056亿元(1,580万美元),一般和行政费用人民币1.503亿元2,240万美元)。 净亏损为人民币2.621亿元(3,910万美元),而2021年同期为人民币2.037亿元。 截至2022年6月30日的三个月,净亏损为人民币2.621亿元(3,910万美元),而2021年同期为人民币2.037亿元。而还有现金和现金等价物1.714亿美元。 过去一年半的中心实验室送检量。 再来看看入院的情况。 净亏损 未公布 以及,除了关注这些公司的主要财务指标之外,在后续还应该关注分析这些公司在财报中还提到了哪些其它信息,看看每家强调的数据有什么不同,更加关注哪些产品和指标。 本文作者:思考问题的熊 版权声明:本博客所有文章除特别声明外,均采用 知识共享署名-非商业性使用-禁止演绎 4.0 国际许可协议 (CC BY-NC-ND 4.0) 进行许可。 如果你对这篇文章感兴趣,欢迎通过邮箱订阅我的 「熊言熊语」会员通讯,我将第一时间与你分享肿瘤生物医药领域最新行业研究进展和我的所思所学所想,点此链接即可进行免费订阅。

Myriad

Natera

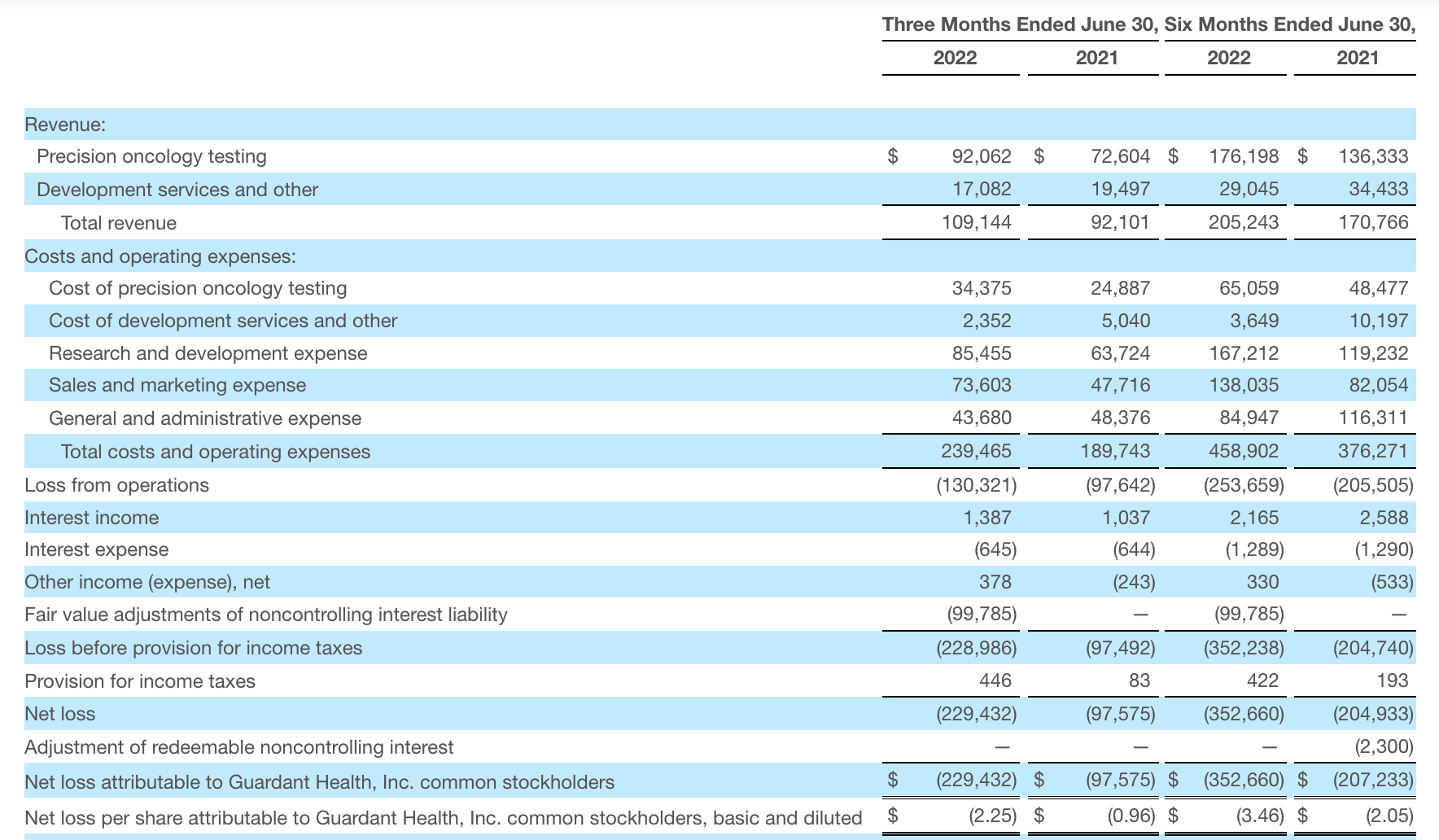

Guardant

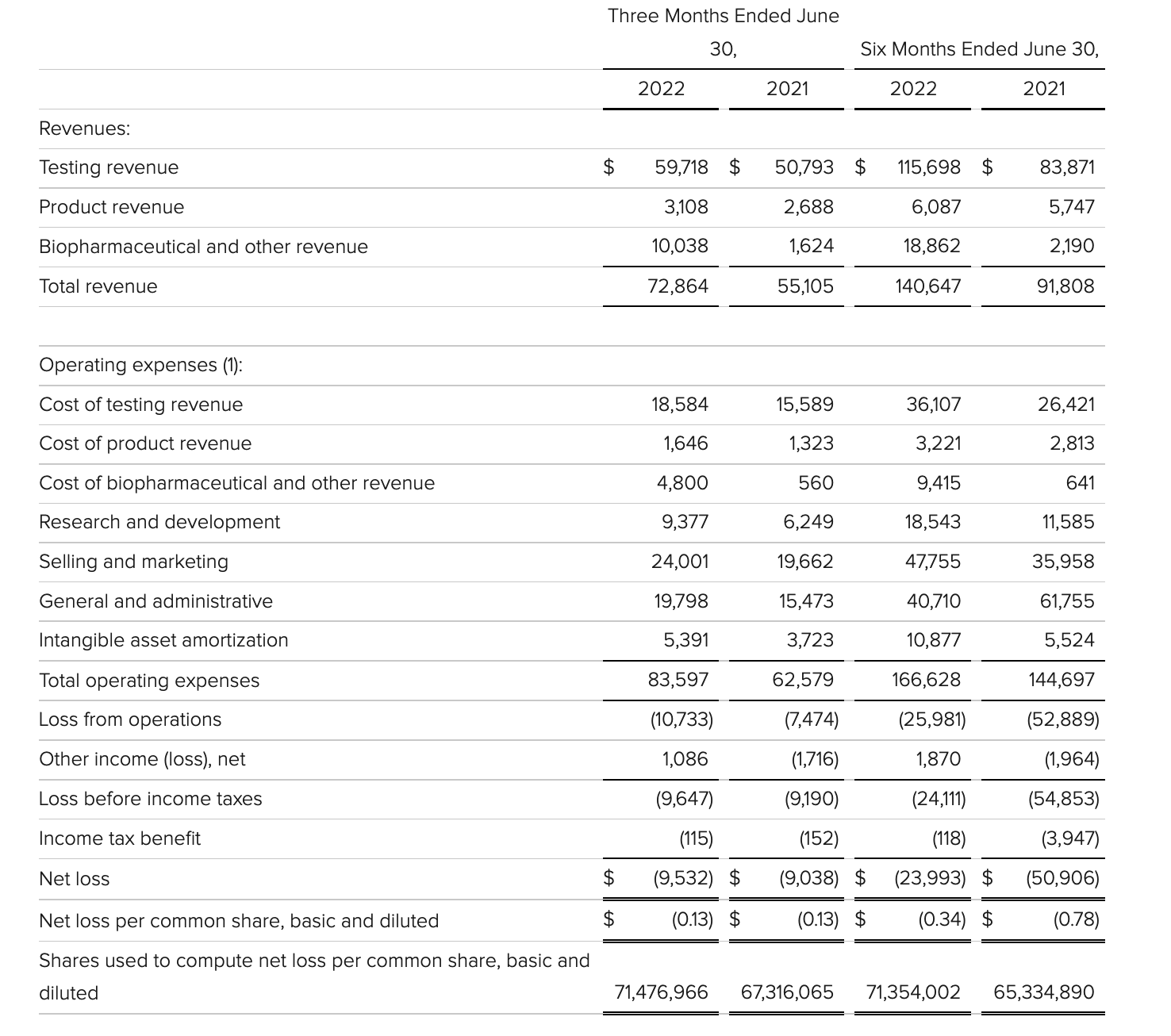

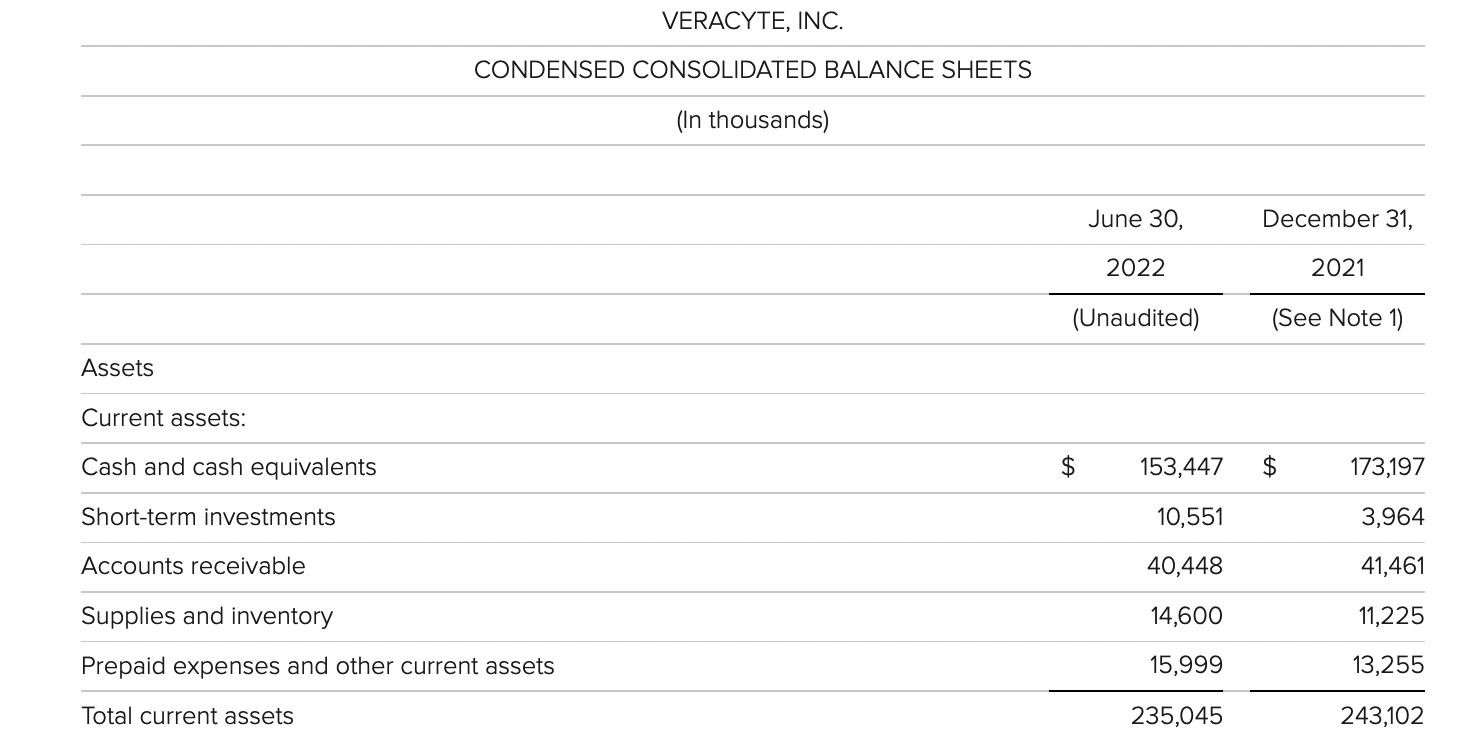

veracyte

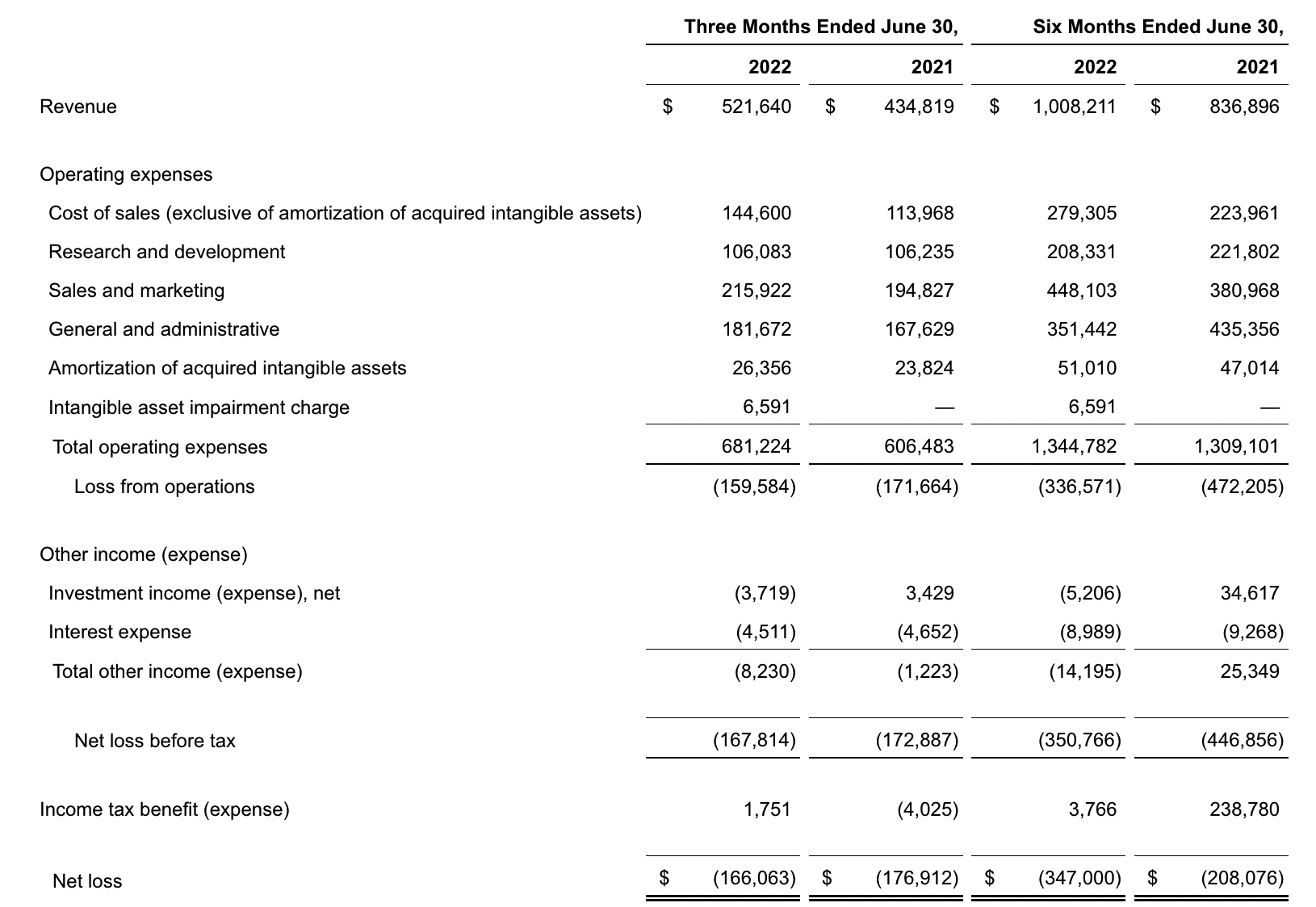

Exact Sciences

Invitae

Oncoctye

GRAIL

燃石医学

泛生子

· 分享链接 https://kaopubear.top/blog/2022-08-08-2022q2-ngs-precision-oncology-revenue/